News

There are 253 new state laws with a January 1, 2019 effective date. Many of these new laws simply clarify existing statutes, while others improve transparency and overall government processes….

Federal Government Bans Bump Stocks In a surprise announcement on Tuesday, the federal Department of Justice (DOJ) issued a ruling banning bump stocks. The DOJ amended the Bureau of Alcohol,…

Do you know a teacher who doesn’t just impart knowledge, but truly inspires students to learn and succeed? Nominate him or her for a Golden Apple Award for Excellence in…

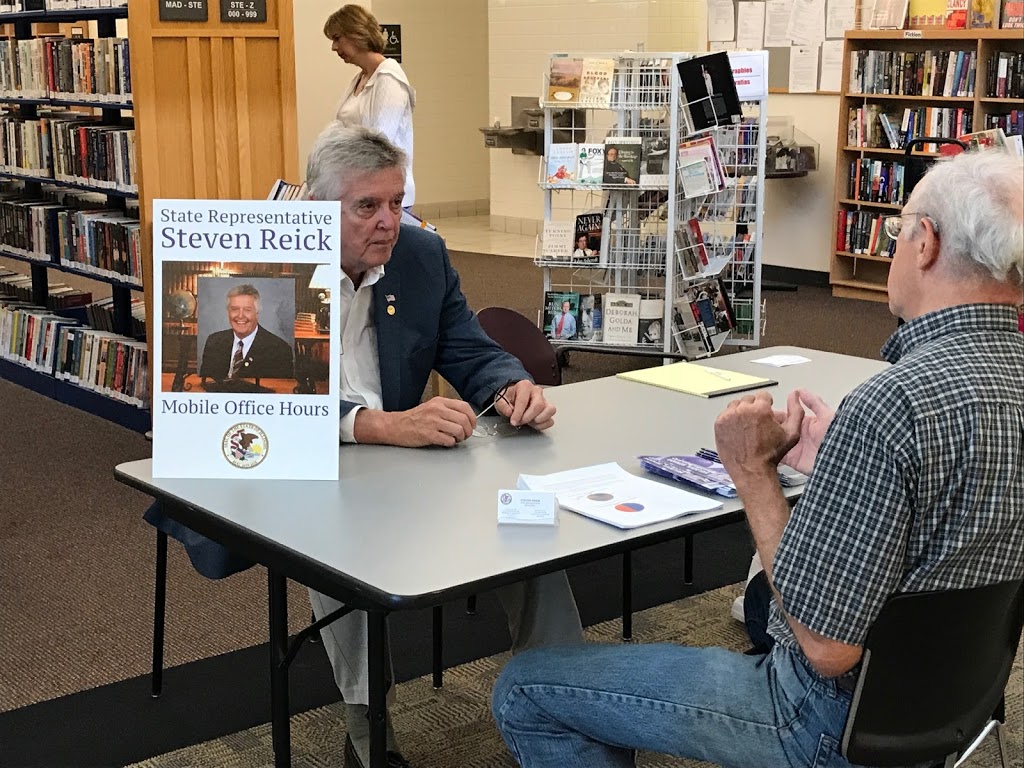

McHenry County’s newest Senator Craig Wilcox (R-McHenry) is partnering with State Representative Steve Reick (R-Woodstock) for a joint mobile office hours event on Wednesday, December 5 at the Harvard-Diggins Library,…

Despite vehement objections by the only member of the Illinois House whose entire constituency resides within the boundaries of McHenry County (Rep. Steve Reick of Woodstock), members of the House…

Despite vehement objections by the only member of the Illinois House whose entire constituency resides within the boundaries of McHenry County (Rep. Steve Reick of Woodstock), members of the House…

State Representative Steve Reick (R-Woodstock) is continuing his mobile office hours tour next week with an event planned for Monday, November 19 at the McHenry Public Library. From 10:00 AM…

State Representative Steve Reick (R-Woodstock) earned high praise on Monday from the Illinois Technology & Manufacturing Association (TMA) for his support of manufacturing in Illinois. Reick’s recognition was based on…

Rep. Reick Addresses Spike in “Failure to Appear in Court” Cases in McHenry County The safety of your family is very important to me, so when I learned that several…

In response to a significant spike in “failure to appear in court” cases in the collar counties, State Representative Steve Reick (R-Woodstock) is championing a new bill that stiffens penalties…